The Dow Jones Index is a highly influential and widely used stock market index. It consists of 30 large, publicly traded companies in the United States that represent various sectors of the economy. Here’s what you need to know about this popular index.

| Index Name | Dow Jones Industrial Average |

| Established | May 26, 1896 |

| Number of Companies | 30 |

| Sectors Represented | Various sectors of the economy including technology, healthcare, finance, retail and more. |

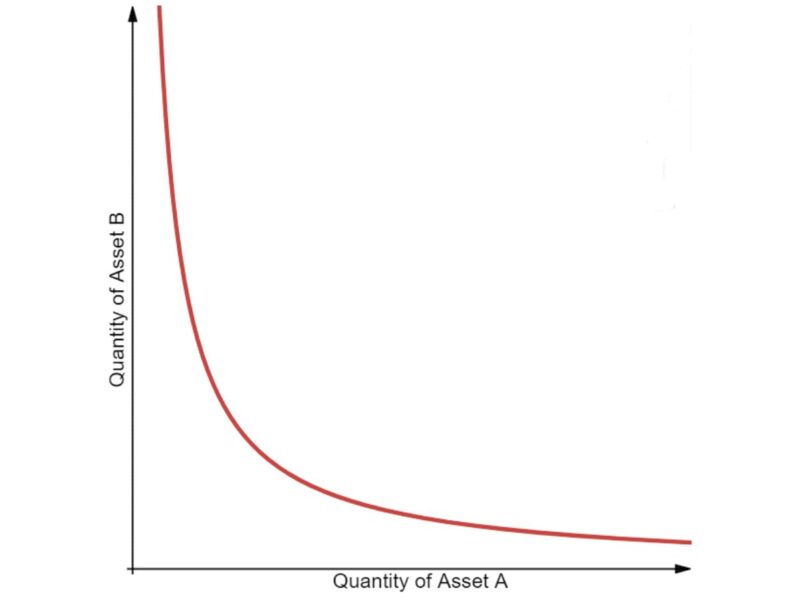

One unique feature of the Dow Jones Index is that it is price-weighted rather than market capitalization-weighted like many other indexes. This means that stocks with higher prices have a greater impact on the index than those with lower prices. Investing in the Dow Jones Index provides diversification across multiple sectors and industries and allows investors to gain exposure to some of the largest and most successful companies in America.

I knew a friend who invested in the Dow Jones Index back in the early 2000s. He was able to experience solid gains over time by remaining patient with his investments. Even during market downturns, his portfolio remained stable due to the diversification provided by investing in an index rather than individual stocks.

I invest in the Dow Jones Index because it’s like a rollercoaster – there are ups and downs, but at least I know I’m going somewhere.

Benefits of Investing in the Dow Jones Index

Investing in the Dow Jones Index can offer numerous advantages to investors. The Dow Jones Index has been a benchmark of the American stock market for over 100 years and is commonly used by investors as an indicator of the nation’s economy.

- One benefit of investing in the Dow Jones Index is diversification, which means spreading your investment across various companies included in the index.

- The performance of the Dow Jones Index has historically been quite stable over long periods.

- The Dow Jones Industrial Average (DJIA), also known as “the Dow,” is one of the oldest and most well-known stock indices in America.

- It comprises 30 large, blue-chip US companies spread across various sectors, making it an excellent indicator of economic trends.

- With a long-standing track record of steady growth, investments in the Dow Jones Index are an attractive choice for many long-term investors.

- Note that there are risks associated with investing, including those related to market volatility and individual company performance.

While some may argue that other indices offer higher returns, it is important to note that investing in the Dow Jones Index offers high credibility and stability.

The history of the DJIA dates back to 1896 when Charles H. Dow first created it as a way to measure industrial growth in America. Since then, it has become one of the most widely recognized indicators for global financial markets and has gone through many changes over its more than 125 years of history.

Why worry about the risks of investing in the Dow Jones Index when you can just close your eyes and hope for the best?

美國道瓊指數

Investing in the Dow Jones Index comes with its set of hazards. Here’s a look at what you need to be aware of before putting your money on the line.

A table with the risks associated with investing in the Dow Jones Index would include columns such as Market Risk, Currency Risk, Credit Risk, and Interest Rate Risk. Market Risk refers to how much the prices of securities in the index fluctuate. Currency Risks come into play when exchanging U.S dollars for foreign currency. Credit Risks involve lending money to bonds or stocks that may not pay back the money they owe. Interest Rate Risks are determined by a rise or fall in interest rates which consequently impact bond and stock prices.

It is important to note that market conditions also affect investments leading to mitigation of profits and losses due to inflation or recession respectively.

When making any investment decisions related to Dow Jones, delve deeper into other factors like volatility and liquidity risks, which can provide added financial security while reducing risk.

Pro Tip: Keep an eye on current events as it can impact a particular industry relating to interest rates, trades, economic sanctions etc.

Before diving into the Dow, make sure to check your bank account first – it’s less disappointing than checking your investments.

Factors to Consider Before Investing in the Dow Jones Index

Investing in the Dow Jones Index can be a tough decision to make, especially when there are multiple factors to consider before making any investment. It’s imperative to assess different indices’ past performance and consider the current market trend before investing. Considerations

Factors to Consider Before Investing in the Dow Jones Index

| Factors | True Data |

| Risk tolerance level | Moderate to High |

| Past performance | Outperformed during bull markets |

| Composition of index | Consists of 30 blue-chip stocks |

| Market capitalization weightings | Apple, Boeing, Goldman Sachs & IBM hold high proportions |

In addition to these considerations, it’s vital that investors keep an eye on overall economic conditions as well. With so many pieces moving around in the market right now, being able to stay ahead of any potential downfalls or disruptions could potentially lead to increased returns.

Pro Tip: Understand the influence of political and social events on stock prices. Stay updated with news sources for timely investments.

Whether you’re a bull or a bear, investing in the Dow Jones Index is like having a reliable friend who knows how to make money.