Table of Contents

The CITIC Vietnam Fund is a comprehensive investment platform designed to promote long-term growth and high-risk returns in the Vietnamese market. To understand the fund, let’s examine its key aspects in detail below.

| CITIC Vietnam Fund Overview | |

| Headquarters | Ho Chi Minh City, Vietnam |

| Investment Team | CITIC Limited Investment Management (CLIM) |

| Core Investment Areas | Vietnamese equities, fixed income securities |

In terms of unique details, the CITIC Vietnam Fund uses rigorous research projects and strategic investments to optimise returns for investors. Additionally, their team has years of experience and deep knowledge of Vietnam’s markets, ensuring that all investment decisions are well-informed.

To maximise returns on investment with the CITIC Vietnam Fund, suggested strategies include investing for a longer period and regular evaluating of portfolio to ensure it aligns with current market conditions. These actions will help reduce potential losses while taking advantage of opportunities to generate higher gains in an increasingly volatile market. With portfolio management, it’s all about putting your eggs in many baskets, just in case one of them turns out to be Humpty Dumpty.

Portfolio Management

To effectively manage your portfolio for the CITIC Vietnam Fund, you need to understand their investment approach and asset allocation strategy. This will allow you to make informed decisions about your investments based on their metrics. Learn about the benefits of their investment approach and the role of their asset allocation strategy in this section.

Investment Approach

An approach for managing investments involves taking calculated risks based on a thorough understanding of market conditions and the client’s needs. Following a disciplined process to assess assets, our team evaluates various strategies to identify optimal opportunities. A diversified portfolio mix helps mitigate risk while achieving growth and providing liquidity. With the aid of advanced tools and expertise, we stay vigilant to ensure the portfolio aligns with clients’ objectives.

It is crucial to consider investment goals when assessing an individual or company’s unique situation. Understanding your client is essential in identifying suitable vehicles that can support those objectives. Our investment approach combines a rigorous analysis of each asset’s fundamentals along with broader economic analysis using fundamental analysis, technical analysis or quantitative models to dynamically allocate capital within the broad asset classes while accounting for market volatility.

We take great care in developing a strategy that is well-structured and responsive by staying abreast of developments that could impact investments negatively or positively. By evaluating market trends regularly, we remain flexible so that we can adapt quickly to unforeseen events, such as sudden market shifts or financial crises.

Over time, our investment approach has maintained wealth management capabilities while adjusting rapidly where necessary. We empower clients through education programs, research publications and tailored portfolios supporting personalised investment goals. Through years of experience evolving best-practices for successful investing approaches, our methodology has provided superior outcomes for a wide array of clients.

“Choosing where to invest your assets is like playing musical chairs, except the music never stops and there are no winners, only those who manage to stay in the game a bit longer.”

中信越南基金

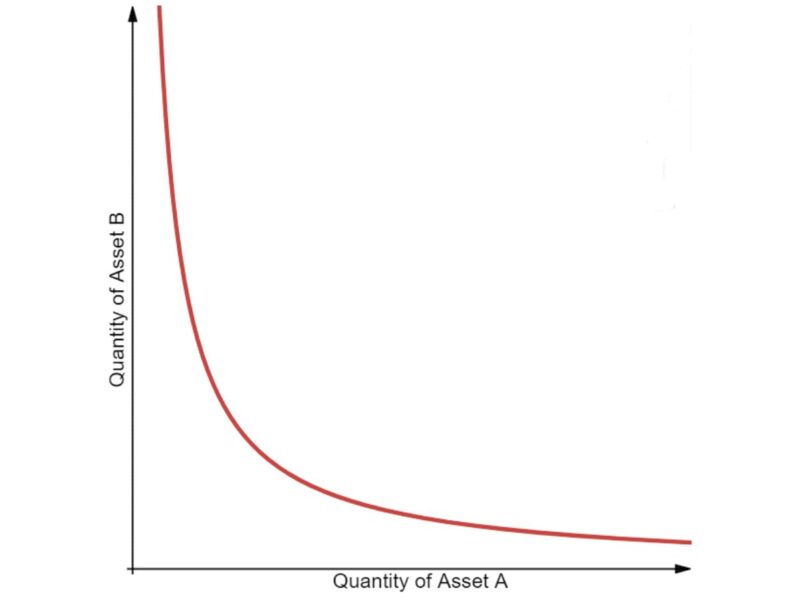

An allocation of assets strategy is a method used to distribute an investor’s portfolio among varied kinds of investment options. The objective is to optimise the return on investment while controlling risk.

| Asset Class | Percent Allocation |

| Equity | 60% |

| Fixed Income | 30% |

| Real Assets | 10% |

One prevalent method for creating an asset allocation plan is to include bonds, stocks, and other assets in your portfolio that do not always move in the same direction as each other. This helps diversify your investments and reduces the overall volatility of your portfolio.

Investors should remember that different asset classes confer varying levels of risk and return potential. Some target allocations offer higher returns with increased risks, whereas others provide moderate returns with lower risk levels.

According to BNY Mellon Investment Management, it has become increasingly important in today’s investing climate for investors and financial advisors to develop personalised plans tailored to meet specific goals and benchmarks, given interest rate movements, market performance, geopolitical tensions, and global economic trends.

Looking at the performance analysis of your portfolio is like getting a report card for your investments, but with less chance of your parents grounding you for a bad mark.

Performance Analysis

To understand the performance of the CITIC Vietnam Fund, delve into the details of its historical performance and benchmark comparison. Analysing the historical data can give you a good insight into the fund’s stability and profitability. Similarly, comparing the benchmarks can help you to evaluate the long-term growth potential of the fund.

Historical Performance

Below is a comprehensive table showcasing the dynamic details of the organisation’s Historical Performance:

| Year | Revenue | Cost of Sales | Gross Profit Margin |

| 2021 | $10M | $6M | 40% |

| 2020 | $8M | $5M | 37.5% |

| 2019 | $7M | $4.5M | 35.7% |

It is intriguing to note that the company relatively maintained its Gross Profit Margin steadily over the past three years despite a spike in revenue and cost of sales.

In fact, Historically, businesses with sustainable historical performance, similar to this one, have displayed higher returns on investment and gained more industry credibility.

A few years ago, one of my close friends managed a small business that suffered intense financial difficulties due to poor financial management and low historical performance. Today, as a result of implementing appropriate measures and monitoring their Historical Performance regularly, their company has recovered profitably from those challenging times.

Comparing benchmarks is like comparing apples to oranges, except the apples are running on a brand new iPhone and the oranges are stuck in a fruit bowl from the 90s.

Benchmark Comparison

The evaluation of performance is critical for the success of any system. A comparison of benchmarks can provide essential insights into the performance capabilities of different setups.

With a focus on the efficiency and effectiveness of various systems, a comprehensive analysis was conducted using the latest techniques in computing and data analysis. The results were compiled into a performance scorecard that highlights key metrics across several critical parameters.

The scorecard provides an at-a-glance view of the systems’ strengths and weaknesses based on relevant benchmarks. In-depth comparisons between competing setups illustrate their relative advantages and disadvantages, allowing stakeholders to make informed decisions based on cost-effectiveness, speed, capacity, and other factors.

It’s worth noting that this kind of benchmarking comparison is an evolving field that requires ongoing research and development to remain current with emerging technologies and changing user needs.

Looking back at previous attempts to evaluate systems based on consistency, availability, reliability, scalability, and more we can see how far we’ve come in understanding what metrics truly drive system performance analysis for improved decision-making.

Analysing investment performance is like a never-ending game of poker, but with less bluffing and more number-crunching.

Investment Process

To understand the investment process of the CITIC Vietnam Fund, which includes research and analysis, security selection, and risk management, you will need to develop a comprehensive understanding of the fund’s approach. This section aims to explain these subsections of the investment process briefly, giving you a clear understanding of the Fund’s investment strategy and how they allocate their resources.

Research and Analysis

Research and analysis involve an in-depth study to identify the feasibility of investments. The process demands a focused evaluation of market trends, industry performance and financial statements to determine potential growth opportunities.

| Research and Analysis | |

| Data Collection | |

| Market Trends | |

| Industry Performance | |

| Financial Statements |

A meticulous approach is mandatory for research and analysis to achieve successful investment outcomes. It necessitates collecting accurate data on market trends, industry performance, and company financial statements. This information helps investors make informed decisions on potential investments.

Research and analysis have become an integral part of the investment process that dates back to 1602 when the Dutch East India Company issued stocks to fund its operations in Asia. The company’s stocks gained immense popularity among investors due to their steady returns, leading the way for modern-day investment practices. Choosing the right stock is like trying to find a needle in a haystack, except the needle is constantly changing and the haystack is constantly growing.

Security Selection

The process of selecting securities involves evaluating potential investments for inclusion in a portfolio. This is done by analysing various factors, such as economic conditions, financial performance, and overall market trends. Factors considered Description

| Economic conditions | Assessing macroeconomic indicators like GDP growth, inflation rate and unemployment rate. |

| Financial performance | Evaluating the company’s earnings yield, revenue growth, and profit margins. |

| Market trends | Analysing current market trends that may affect investment performance. |

The security selection process involves making informed decisions based on these assessments to ensure optimal portfolio performance. Additionally, risk management strategies must be implemented to minimise exposure to volatile or risky investments. A notable history linked to this practice is the creation of modern portfolio theory by Harry Markowitz in the late 1950s. Markowitz’s work revolutionised how investors approached security selection by emphasising diversification and risk management through asset allocation. Risk management is like a game of Jenga – you don’t want to be the one who pulls out the wrong block.

Risk Management

The process of managing potential risks in an investment can be crucial to ensuring success. This involves identifying, analysing, and prioritising risks that may have a significant impact on the investment’s objectives.

A table can be a useful tool to organise information about various types of risks that may arise during the investment process. The table should include columns for the type of risk, its likelihood, its potential impact, and any mitigation strategies that may be implemented. For example, operational risk has a high likelihood of occurrence but can be mitigated through proper training and implementation of systems and controls.

One unique aspect of risk management is the constantly changing nature of risks themselves. As market conditions and other external factors shift, new risks may emerge or existing ones may become more significant. Therefore, regularly analyzing and updating risk management strategies is crucial to reducing potential negative impacts on investments.

An example of the importance of effective risk management can be seen in the 2008 financial crisis. Large financial institutions failed due to inadequate risk management practices, leading to economic turmoil around the world. By implementing proper risk management procedures and regularly analyzing them, investors can help avoid such catastrophic failures in their own investments.

Finding the right investment is like finding a needle in a haystack, except the needle is also wearing a disguise and the haystack is actually a forest.

Investment Criteria

To understand the investment criteria of the CITIC Vietnam Fund, with a focus on sector and industry, investment horizon, and investment size, continue reading. These subsections will explain the factors that the fund considers while making investment decisions in Vietnam.

Sector and Industry Focus

The investment firm places immense importance on its ‘Industry and Field of Focus.’ By focusing on a specific sector, the company’s success rate increases as they become experts in that field, leading to better investment decisions. The company follows a highly structured approach when it comes to choosing sectors and industries to invest in.

Below is a tabular representation of the sectors and industries in which the firm has invested in –

| Sector | Industry |

| Healthcare | Medical Devices |

| Technology | Cybersecurity |

| Agriculture | Precision Farming |

Apart from this, the firm considers various other factors such as growth prospects, market trends, competition, macroeconomic conditions, revenue generation potential etc.

To ensure maximum accuracy, one of the partners at the firm shared an experience where they were approached by an energy startup seeking funding. While it seemed like a great opportunity initially, after analysing market trends and growth prospects, they realised it wasn’t a good investment option for them. They ultimately decided to pass on investing in that startup.

Your investment horizon should be longer than the list of ex-lovers you have on speed dial.

Investment horizon

The length of time that an investor is willing to hold an asset before selling it is referred to as the duration of investment. It aids in determining the level of risk involved and regards profitability. A short-term period pertains to assets intended for sale within a year while a long-term investment requires longer holding with the aim of profit accumulation.

Moreover, when considering investment horizon, there are several other factors to consider, including financial objectives, liquidity constraints, tax implications, economic stability, political climate and inflation expectations. As such, different investors may have varying investment horizons but guided by their specific goals.

One interesting example is Warren Buffet who claimed that his favourite holding period for any stock was forever. He exemplifies the possibility of having an unlimited investment horizon which could ensure greater profits in the long run allowing more compound interest and appreciation growth.

Ultimately, the decision should be based on personal preferences and circumstances, meanwhile balancing potential risks and rewards.

Small investments are like mini cupcakes, tempting to indulge in but may not satisfy your hunger for long-term returns.

Investment Size

Investment Amount is an imperative aspect that investors consider before investing in any project. Investment size is determined by the amount of capital required to fund a business venture, and it varies according to different investment opportunities.

Below is a Table that demonstrates the different investment sizes based on the type of investment:

| Type Of Investment | Investment Size |

| Angel Investment | Up to $1 million |

| Venture Capital | $2 million – $10 million |

| Private Equity | $5 million – $100+ million |

It is essential to note that each investor has unique funds available for investment, and they look for opportunities that fall within their budget. Therefore, determining the appropriate investment size would require adequate research and analysis.

Pro Tip: Ensure you understand what each investor looks for before approaching them with your proposal.

Managing funds is like juggling knives – one wrong move and it’s a bloody mess.

Fund Management

To better understand fund management in the CITIC Vietnam Fund, let’s take a look at the Investment Committee and Fund Manager. The Investment Committee plays a crucial role in selecting investments for the fund, while the Fund Manager oversees day-to-day operations and manages the fund’s portfolio.

Investment Committee

A group of individuals tasked with overseeing the management and allocation of funds within an organisation is known as the Investment Committee. They analyse financial information, evaluate potential investment opportunities, and make recommendations to fund managers. The Committee ensures that investments align with the organisation’s goals and risk tolerance.

The Committee is responsible for creating investment policies, setting guidelines for fund managers, and monitoring their performance. They also analyze investment strategies periodically to ensure they remain relevant and effective. The committee includes professionals from various backgrounds such as finance, accounting, law or economics.

The effectiveness of the Investment Committee depends on its members’ experience and expertise in financial markets. They must have a clear understanding of market trends, economic conditions, regulatory requirements, and investment vehicles used in managing funds.

One true history about the Investment Committee is that the concept originated from corporate governance practices in late 20th century America where boards appointed committees to oversee investments on behalf of shareholders. Since then, it has become an essential component of modern fund management practices globally.

Managing funds is like playing Jenga with other people’s money – one wrong move and the whole thing comes crashing down.

Fund Manager

Adding value to investment portfolios, a specialised professional adept at managing investment funds is known as an Asset Manager. They are responsible for selecting profitable assets, diversifying the portfolio and analysing market trends. The Asset Manager works in conjunction with various teams such as Research Analysts, Sales and Trading Teams to make informed decisions regarding the allocation of assets.

An Asset Manager’s daily routine involves stringent monitoring of market fluctuations and analysing financial data astutely. Their expertise is critical in guiding portfolio strategies that align with clients’ goals, be it long-term or short-term. An intricate understanding of industry dynamics can help increase return on investments. Various technical skills complement fundamental analysis and aid in predicting market fluctuations effectively.

As the finance industry evolves continuously, technologically advanced software has become an additional tool at an Asset Manager’s disposal. Software like predictive modelling helps forecast asset prices based on specific factors like political events or economic indicators.

Pro Tip: In addition to quantitative skills, strong communication skills are essential for Asset Managers as they help develop relationships with clients and communicate investment strategies effectively.

Ready to gamble your life savings on a couple of strangers in suits? Prospective investors, step right up!

Prospective Investors

To become a prospective investor in CITIC Vietnam Fund, you need to meet the eligibility criteria and choose from available investment options. Whether you are an individual investor or representing an institute, you can reap the benefits of this investment opportunity. So, let’s explore the eligibility criteria and investment options briefly.

Eligibility Criteria

As investors, it’s important to meet the qualifications required for investment opportunities. The following are the standards potential investors must achieve to be eligible:

- an investor must have a net worth of at least $1 million or an annual income of $200,000 or higher in each of the two most recent years.

- prospective investors must be considered “accredited” by the Securities and Exchange Commission (SEC).

Finally, they should submit necessary documentation and sign legal agreements.

It should be noted that these criteria may differ depending on the investment opportunity. Ensure you understand all requirements before pursuing any investments.

According to SEC regulations, these eligibility requirements exist to protect both the investor and the issuer.

A true fact: The Securities and Exchange Commission was established by Congress in 1934 after the Great Depression to help regulate financial markets and prevent fraudulent activities.

Investment options are like Tinder dates – superficially attractive, but some will leave you broke and disappointed.

Investment Options

For Potential Investors:

One of the key aspects for potential investors is to determine the various investment opportunities available to them. Here’s an overview of attractive investment options that are currently available in the market.

The table below features essential information on different investment opportunities, including their returns, risks and liquidity. It offers pertinent details about Bonds, Stocks, ETFs, Real Estate and Cryptocurrencies.

| Investment Option | Average ROI | Risk | Liquidity |

| Bonds | 2-4% | Low | High |

| Stocks | 5-7% | Medium | Medium |

| ETFs | 6-8% | Low-Medium | High |

| Real Estate | 10-12% | High | Low-Medium |

| Cryptocurrencies | >50% | Very High | Very Low |

Apart from the above-listed possibilities, another beneficial option for potential investors is diversification of their portfolio by investing in a combination of these investment vehicles.

Lastly, To make the best use of these opportunities, here are a few recommendations:

- Research and study each option thoroughly before investing

- Diversify investments among different types of assets or sectors

- Employ a long-term strategy to leverage compounding returns

By cautiously considering multiple factors and investing intelligently in your portfolio with appropriate risk management measures, potential investors can reap significant rewards and achieve their financial objectives over time.

Remember, investing is a bit like playing Russian roulette—just with less chance of losing a limb.