Automated Market Makers (AMM) have been major players in the development of decentralized finance (DeFi) and are transforming how investors trade crypto assets. Unlike centralized exchanges, which require buyers and sellers and a central reserve of assets, AMMs crowdsource liquidity to enable token swaps and value exchange on DeFi platforms. This allows for a more accessible, stable, and efficient trading environment for investors. AMMs are also more secure than centralized exchanges and can withstand hacking attempts because they do not rely on a single central authority to maintain security and integrity.

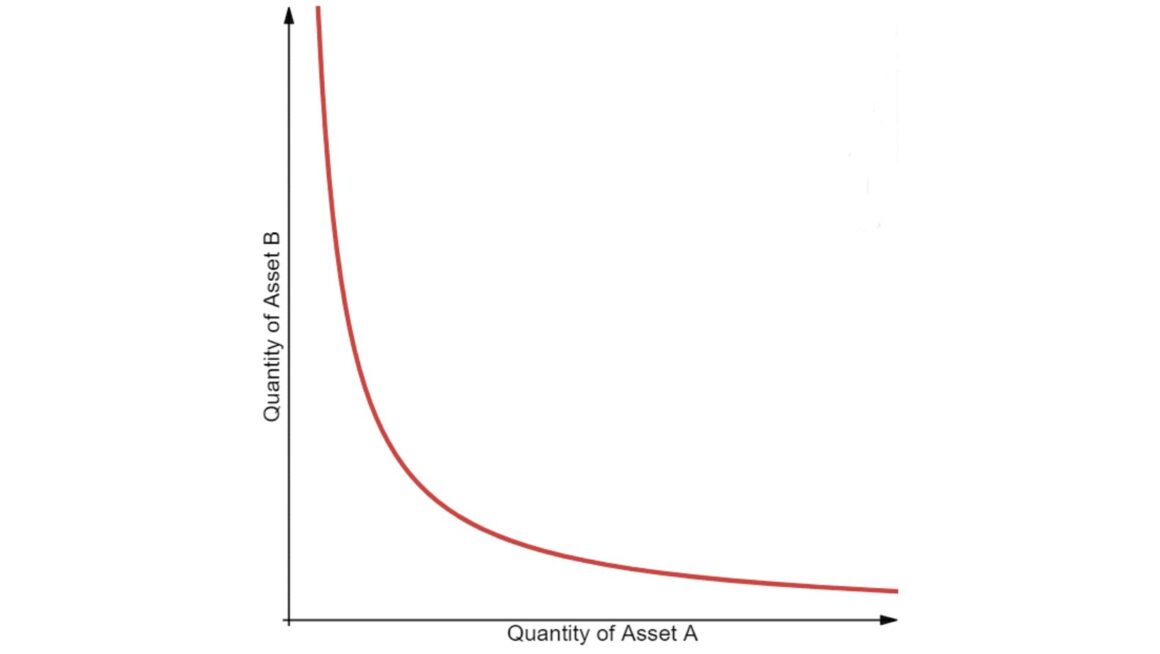

AMMs work by crowdsourcing cryptocurrencies through a series of liquidity pools and executing trades on behalf of traders using smart contracts. These programs automatically price assets using an algorithm, avoiding any potential human interference and eliminating high slippages and manipulation. This makes them a critical component of decentralized trading and enables the DeFi industry to operate in a more transparent manner.

The AMM model can be compared to how traditional stock exchanges and centralized cryptocurrency exchanges express supply and demand in order books to determine asset prices. The goal is for the buyer to buy at the lowest possible price and for the seller to sell at the highest price. However, this doesn’t always work in practice because the price ratio of a token pair can shift due to various reasons, and large fluctuations often occur. When the price ratio of a token pair changes dramatically, it can result in an impermanent loss for the liquidator. The risk of an impermanent loss prevents many people from withdrawing their assets from the pool for fear of losing money, which means they miss out on other profitable opportunities. This can be mitigated if stablecoin or wrapped token pairs are used in AMMs as they have more stable value.

Traders are often attracted to the AMM crypto model because it’s simple to use and eliminates the need for counterparties. While this is true, AMMs still need regular users to provide liquidity and reduce slippage. These users are called liquidity providers, and they contribute their crypto assets to the relevant liquidity pools. In return, they get a share of the trading fee.

These LPs are usually given a governance token that gives them voting rights for the platform in addition to the income they receive from transaction fees. Additionally, they can benefit from yield farming by moving their assets between different pools to maximize earning opportunities.

In order to accurately and reliably price assets, AMMs need a reliable data feed. Chainlink is a price feed that is helping to power the AMM models of various decentralized exchanges and has already been integrated by projects like Sigmadex, DODO, and Bancor 3. The inclusion of the Chainlink price feed in these projects has allowed for trust-minimized, automated markets with the flexibility to meet the needs of each specific market. In the future, we can expect to see more AMMs adopt the Chainlink technology and provide liquidity to decentralized exchanges in a trustworthy and safe manner.