Table of Contents

The Bitcoin halving is pivotal in the crypto industry, influencing market dynamics and miner profitability. With approximately six months until the next halving, experts and enthusiasts alike are fervently speculating on BTC’s price movement leading up to and following this crucial juncture. Let’s delve into the significance of this event that has captivated the crypto world and explore the projections from industry professionals.

What is Halving?

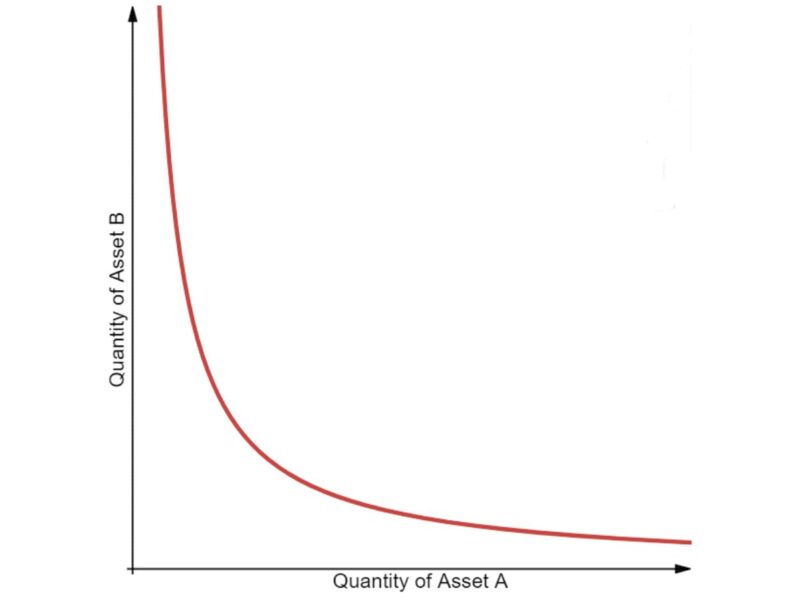

Halving, a planned reduction in the issuance of new coins given to miners who validate transactions on the network, is a regular event occurring every four years. Bitcoin has undergone three halving events thus far. The initial one transpired in November 2012, decreasing the block reward (the amount of Bitcoin miners receive for confirming each transaction block) from 50 to 25 BTC. Then, in July 2016, the reward was further halved from 25 to 12.5 BTC. The most recent halving took place in May 2020, lowering the reward from 12.5 to 6.25 BTC.

Anticipated in April 2024, the forthcoming Bitcoin halving will see the block reward reduced to 3.125 BTC, consequently lowering the annual Bitcoin inflation rate from 1.7% to 0.8%. The ultimate halving is slated for 2140, marking the conclusion of Bitcoin mining and resulting in a total supply of precisely 21 million coins.

Do Altcoins Have Halving?

Halving is built into the Bitcoin code to ensure that the total number of coins in the network never exceeds 21 million units. But what about altcoins? The fact is that Bitcoin’s monetary policy is unique compared to most other crypto assets, which tend to experience inflation. Cardano (ADA) has 7% inflation and Solana (SOL) has 8% long-term inflation. What do SOL vs ADA have in common that prevents them from halving? These coins operate on the Proof-of-Stake (PoS) algorithm. By the way, for Ethereum, after the blockchain transitioned to the PoS algorithm, the inflation rate became negative, as the volume of transaction fees burned on the network exceeded the volume of newly issued ETH coins.

Bitcoin works on a Proof-of-Work (PoW) algorithm, and other coins that work in the same way, such as Litecoin (LTC) or Zcash (ZEC), also have halving. But it is not always the case. Monero is a cryptocurrency whose consensus mechanism is conceptually similar to that of Bitcoin, but there is no such thing as the Monero halving. The privacy crypto uses a different method of gradually slowing down the rate at which XMR coins are created. Therefore, if you want to have coins that are subject to halving, it is worth turning to XMR to BTC exchange to get some.

Halving Impact on Price

By assessing the price performance of three Bitcoin halving cycles over a two-year period starting one year before each halving and ending one year after it, one can get an idea of the Bitcoin price trajectory as the fourth halving approaches. Over such a two-year period in 2012, the growth of the Bitcoin rate was about 30,000%, in 2016 – 786%, and in 2020 – 712%.

Nonetheless, historical performance does not assure future outcomes, and numerous additional elements come into play in shaping Bitcoin’s price. Moreover, as Bitcoin develops and becomes more widespread, its price may become less volatile and more stable over time.

Experts’ Expectations for Bitcoin Halving

Since the beginning of 2023, the main cryptocurrency has risen in price by 67%, partially recovering from an epic fall below 16,000. Although Bitcoin is currently still fighting hard to return to the $30,000 mark, well-known cryptanalysts are predicting significant growth for it.

Adam Back, the visionary leader at Blockstream, confidently foresees digital gold soaring to an esteemed pinnacle of $100,000.

Pantera Capital, a trailblazing American hedge fund with a keen eye on cryptocurrencies, boldly asserts that Bitcoin is poised to scale unprecedented heights, surging to an astounding $150,000.

Across the pond, Chartered Bank, a venerable British multinational financial institution, echoes this sentiment, envisaging Bitcoin’s ascent to a remarkable $120,000 by 2024.

In stark contrast, JPMorgan adopts a more restrained stance on Bitcoin’s trajectory, projecting a modest value of $45,000. This represents a notable dip from the zenith of $69,000 attained just two years prior.