Table of Contents

In the world of cryptocurrencies, there is a vast array of digital assets to explore. One such asset that has gained significant attention is Dai. However, despite its growing popularity, there are still many misconceptions surrounding this stablecoin. In this article, we aim to demystify Dai and provide you with a comprehensive understanding of its workings, benefits, and common misconceptions. Official website of Bitsoft360, which is an online trading platform, offers users a convenient way to engage in cryptocurrency trading.

What is Dai?

Unlike traditional cryptocurrencies such as Bitcoin, Dai’s value is pegged to the US dollar. It achieves this stability through the use of smart contracts and a collateralization system. By leveraging blockchain technology, Dai aims to provide a reliable and steady value, mitigating the price volatility commonly associated with cryptocurrencies. This stability makes Dai an appealing option for various use cases, including a medium of exchange, a store of value, and a stable unit of account in decentralized applications and blockchain-based financial services.

Dai’s stability is achieved through a combination of mechanisms. Smart contracts automatically respond to market dynamics to maintain Dai’s value at 1 Dai equal to 1 USD. . This collateral acts as a guarantee for the issuance of Dai, and if the value of Dai drops below $1, the CDPs are liquidated to maintain the pegged value. This innovative design ensures the stability, transparency, and decentralization of Dai, making it a significant advancement in the realm of stablecoins.

How Does Dai Maintain Stability?

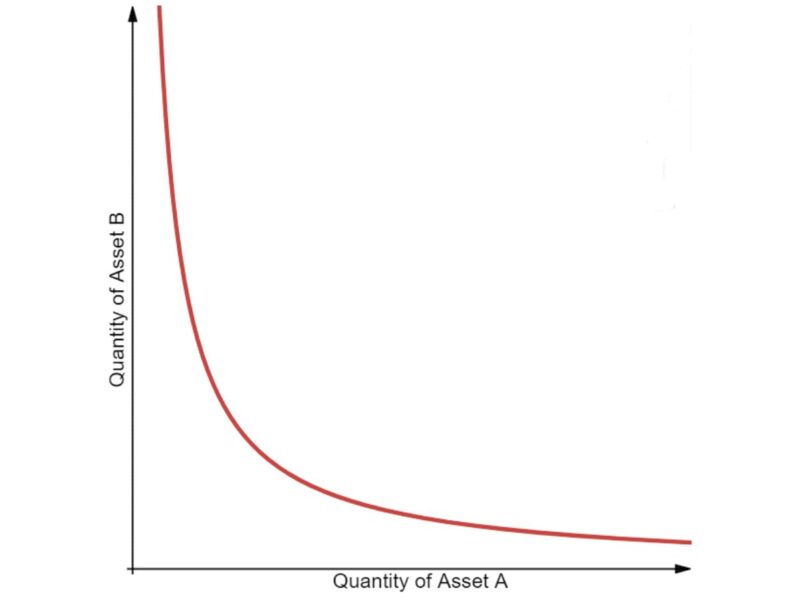

Dai achieves stability through a mechanism called Collateralized Debt Positions (CDPs). Users lock up their Ether (ETH) as collateral in a smart contract and generate Dai against it.

The collateral acts as a guarantee for the value of the generated Dai. If the value of the collateralized Ether drops below a certain threshold, the system automatically liquidates the CDP to maintain the stability of Dai.

Common Misconceptions About Dai

Misconception 1: Dai is Centralized

Contrary to this belief, Dai is a decentralized cryptocurrency. The smart contracts governing Dai’s creation, collateralization, and stability are open-source and transparent, providing users with full visibility and control over their funds.

Misconception 2: Dai is Volatile

While many cryptocurrencies experience significant price volatility, Dai is designed to be a stablecoin. Its value is pegged to the US dollar, ensuring a relatively stable price compared to other cryptocurrencies. This stability makes Dai an attractive option for users seeking a reliable store of value or a medium of exchange.

Misconception 3: Dai is Risky

Some people believe that using Dai involves substantial risk due to its collateralization mechanism. However, the smart contract system behind Dai has been thoroughly audited and tested to ensure its security and reliability. Moreover, the collateralization ratio of Dai is carefully managed to mitigate the risk of volatility in the underlying assets.

Misconception 4: Dai Lacks Transparency

All transactions and smart contract interactions involving Dai can be viewed on the blockchain explorer. This transparency enables users to verify the integrity of the system and ensures that Dai operates as intended.

Benefits of Dai

Stability

The primary benefit of Dai lies in its stability. By maintaining a peg to the US dollar, Dai provides users with a reliable and predictable value.

This stability can be particularly useful in regions with volatile fiat currencies or for individuals seeking a safe haven for their funds during periods of market turbulence.

Decentralization

Dai embraces the principles of decentralization. As a decentralized stablecoin, it removes the need for intermediaries and central authorities, allowing users to have direct control over their funds. This feature aligns with the core philosophy of cryptocurrencies, empowering individuals with financial sovereignty.

Accessibility

This accessibility enables individuals from all corners of the world to participate in the digital economy, regardless of their geographical location or the limitations of the traditional banking system.

Conclusion

Dai is a revolutionary stablecoin that combines the benefits of cryptocurrencies with the stability of traditional fiat currencies. By addressing common misconceptions and understanding their underlying mechanisms, users can confidently explore and utilize Dai for various financial purposes. Its stability, decentralization, and accessibility make Dai a promising asset in the ever-evolving landscape of cryptocurrencies.