Table of Contents

The latest happenings in the United States stock market provide us with a dynamic overview of the current financial state. Current news reports indicate fluctuations in stocks and shares, as well as alterations in trading patterns of key sectors such as technology and healthcare. With many investors monitoring such movements through updated data feeds and real-time information, understanding the implications of these changes is crucial for staying ahead in the game.

Moreover, analysts have noted signs of increasing uncertainty across several markets due to ongoing global factors such as fluctuations in currency values and political instability. As we continue to stay abreast of developments that influence investment trends both domestically and internationally, it is pivotal to remain vigilant on potential risks that may arise.

Looking towards future growth prospects, prominent companies are set to report earnings over the upcoming weeks. Investors will be keeping a keen eye on earnings results, which can significantly impact stock prices both positively and negatively.

Interestingly, throughout history intricate systems surrounding trading practices have evolved from early models used centuries ago. Bartering items were once commonplace; enabling transactions without currencies or paper money. Over time this has developed into complex exchanges fueled by sophisticated technologies – ever-changing yet critical elements required for determining shifts within lucrative trading spaces.

Seems like the only trend in the US stock market is that even the analysts can’t predict what’s coming next.

Latest Market Trends

Discover the most recent updates of the US stock market with comprehensive insights. Get up-to-date information on top-performing stocks and emerging trends in the market.

The Latest Market Data table displays the most recent stock market trends, covering the top-performing stocks, their current prices, market cap, and the percentage change in value. Company Name, Stock Price, Market Cap, % Change.

Gain insight into the unique features of the US stock market through charts and graphs, showcasing the overall performance of the market and highlighting notable trends.

Get a head start in the stock market by keeping up with the latest market trends and making informed investment decisions. Stay ahead of the game and do not miss out on the opportunities the market presents.

Some might say the S&P 500 is like a rollercoaster – except there’s no fun, no thrills, and you’re stuck on it for years.

今日美國股市

The evaluation of the S&P 500’s performance can provide insights into the stock market’s overall trends and fluctuations. To dive deeper into this analysis, a comprehensive analysis of true data is necessary.

The following table shows the data for S&P 500:

| Column 1 | Column 2 | Column 3 |

| Date | Open | Close |

| Jan 2021 | 3790.67 | 3714.24 |

| Feb 2021 | 3732.79 | 3811.15 |

| Mar 2021 | 3867.16 | 3974.54 |

In addition to the standard metrics, unique indicators can add value to the assessment of stock performance. Factors such as earnings reports and geopolitical events should also be considered while making investment decisions.

Pro tip – While analysing stock market trends, focusing on long-term patterns can provide valuable insights for successful investments.

Today’s stock market is a lot like a seesaw, with some companies going up and others just trying not to get motion sickness.

Top Gainers and Losers of the Day

Investment Market Shifts: Stock Winners and Losers

The stock market has experienced significant changes over the last 24 hours, with some stocks making significant gains while others incurred losses. Here is an overview of the most critical shifts in today’s trading session.

Below is a table indicating the top-performing and worst-performing stocks based on their performance during the day.

| Stock Name | % Change |

| ABC | +10% |

| XYZ | +7.5% |

| PQR | +6.2% |

| DEF | -9.5% |

| GHI | -8.1% |

| JKL | -6.7% |

While some investors saw profits through strategic positions in ABC, XYZ, and PQR stocks, those invested in DEF, GHI, and JKL might have incurred losses.

It is important to keep an eye out for emerging trends as they emerge in the stock market. Investing based on past performances may not yield guaranteed results since stocks are generally unpredictable.

Although it’s well-known that recessions could impact large corporations’ profitability significantly, small business owners can also face financial turmoil due to sudden economic downturns- A small business owner’s failure during this period would only worsen their financial woes which investors must inevitably take into consideration when investing in companies that rely on these smaller businesses alike.

Investment success stories abound in the world of WallStreet – but having a balanced investment portfolio is crucial for consistent returns and minimising risks- be sure to diversify your portfolio for maximum gain!

Market volatility is like a rollercoaster ride – the only difference being that you don’t scream when it goes up.

Commentary on Market Volatility

As we delve into the current market conditions, the erratic fluctuations in prices have prompted much discussion. The topic of Market Volatility has been a prevalent one and is receiving more attention than ever before. Many experts attribute this instability to various factors such as political uncertainty, rising inflation and the pandemic’s impact on businesses worldwide.

As we evaluate the trends, it appears that there are glimmers of positivity as particular industries experience growth while others suffer losses.

The term ‘Commentary on Market Tumultuousness’ encompasses many critical aspects that contribute to market volatility. We’re seeing a pronounced swing in prices across industries, with some sectors experiencing significant upturns while others falter. Investors have become increasingly cautious about where they put their money, leading to increased volatility in the markets.

It’s important to note that while some companies may be negatively impacted by volatile conditions, others can position themselves for success and take advantage of market opportunities. Still, experts advise investors to stay vigilant amid the fluctuations and remain cognisant of their portfolios’ risk management strategies.

Pro Tip: Diversification can prove to be an effective strategy during times of market volatility as it spreads potential risks over various investments.

From major mergers to minor scandals, this section has all the juicy company gossip you’ll need to impress your coworkers at the water cooler.

Company News and Headlines

The Latest Developments in Corporate Announcements

The stock market is constantly in flux, and players must stay up-to-date on the latest developments in corporate announcements. Here, we provide key insights into the most recent company news, including headlines and market movements. Cornerstone industry players are discussed alongside emerging players, ensuring a holistic picture of the current state of the market.

Our analysis goes beyond basic news reporting, offering investors underlying trends and unique insight into potential changes in company strategy. We strive to provide investors with a comprehensive understanding of the market to aid informed decision making.

We understand that digesting and processing the plethora of data can be challenging. As such, our experts make sense of complex information, providing investors with a clear view of the key drivers of key market movements.

The Evolution of Stock Market Volatility

As the stock market evolves, volatility has become a prominent concern for investors. The current state of market volatility reflects the market’s response to new developments in company news and other factors. Our analysis offers investors an in-depth understanding of market volatility and its implications for portfolio management.

We use a combination of tools and techniques to identify factors contributing to market volatility. Our robust analysis can help investors navigate periods of market turbulence with confidence.

Trading in an Evolving Stock Market

The stock market is constantly evolving, and traders require keen insights into the market’s ever-changing conditions to make informed trading decisions. Our analysis provides traders with accurate and timely information on the latest developments in company news and market trends, allowing them to make well-informed decisions that drive their success.

We offer unique insights into the behaviour of the stock market and the driving factors behind stock price movements. Our analyses help traders stay ahead of market movements, offering them a competitive edge in one of the world’s most fast-paced industries.

The Rich History of Stock Market Trading

The stock market has a rich history that is intertwined with key events in world history. Our analysis traces the history of the stock market, providing insights into the key innovations and milestones that have shaped the market. We believe that a deep understanding of the history of the market is essential for informed decision-making in the present day.

Our analysis looks at how the evolution of trading platforms, investor behaviour, and government regulation has shaped the stock market we know today. This understanding is crucial for investors looking to make informed decisions amidst the constantly changing market forces.

Looks like these major companies are making more money than I’ll ever see in my lifetime, but at least I can still afford a Netflix subscription…for now.

Financial Results of Major Companies

The current financial statistics of leading companies have been compiled for analysis. The performance of notable firms is detailed in the subsequent table, highlighting relevant figures and ratios without deviations.

| Company | Revenue (in millions) | Net Income (in millions) |

| Apple Inc. | 274515 | 57411 |

| Amazon.com Inc. | 386064 | 11588 |

| Alphabet Inc. (Google) | 182527 | 39647 |

It is crucial to note that this is merely a snapshot of their monetary status which does not encompass all metrics, but only the critical financial aspects observed. Novelties like procedures implemented and announcements given by these behemoths shape some parts of their probable success in upcoming periods.

Do not miss out on observing the current economic climate being navigated by these entities. Invest in your knowledge and strive to stay informed for wise decisions as an entrepreneur or investor moving forward.

Looks like the top brass at the company is getting their own version of ‘musical chairs’ – let’s hope there aren’t any bad notes in this symphony of board changes.

CEO or Board Changes

Recent Changes in Top Management

The company has announced significant adjustments at the executive level, leading to new faces and roles. The CEO or Board Members may have undergone reshuffling or been replaced. The new appointments demonstrate the company’s strategic approach to ensure continued growth and success.

This latest shake-up reflects the organisation’s commitment to align with its vision and mission. The management changes will provide fresh perspectives, knowledge, and expertise that will drive innovation, improve customer satisfaction, and bolster shareholder value.

It is noteworthy that the changes appear timely given the current market conditions, which necessitate targeted action to remain competitive. The company is well-positioned to capitalise on these shifts due to its robust leadership team.

To address your concerns effectively during this transition period, we encourage you to reach out through established channels for updated information and support. These channels include our website, social media pages, email updates or contacting us directly via phone or email.

We urge our stakeholders to remain optimistic about this development and embrace change as an opportunity for growth rather than a cause for concern. Rest assured that we are taking all necessary measures to ensure a smooth transition of leadership while maintaining our focus on delivering top-notch services and products to our valued customers.

Looks like the company is playing a game of corporate Jenga with all these mergers and acquisitions – let’s hope they don’t topple over.

Mergers and Acquisitions

The amalgamation of business operations and ownership, involving either merging two different entities or an acquisition.

| Company | Merged/Acquired | Deal Value |

| Company A | Acquired by Company B | $500 million |

| Company C | Merged with Company D | $1 billion |

Moreover, certain acquisitions have led to stakeholder conflicts requiring legal intervention.

According to the Wall Street Journal, the recent acquisition has led to a decline in shareholder value.

Looks like the tech sector is hotter than a malfunctioning laptop right now, with companies making headlines faster than their products can crash.

Sector-Specific News

In the world of US stock market news, keeping up-to-date with sector-specific events is crucial for investors. Such events can affect different sectors in unique and significant ways. For instance, changes in regulations can impact the healthcare sector, while the technology sector can be affected by mergers and acquisitions. Therefore, having access to sector-specific news can assist investors in making informed investment decisions with confidence.

Analysing sector-specific news can help investors in various ways. For instance, it allows them to determine which businesses are likely to thrive under certain economic conditions. Additionally, it helps investors in identifying stocks that are undervalued or overvalued. Moreover, it can reveal emerging opportunities or highlight risks that are specific to a particular sector.

However, it is essential to interpret sector-specific news with caution. Investors should take into account other factors such as market trends, company data, financial performance, and global events. By analysing a range of data, investors can make informed investment decisions.

In recent years, the healthcare industry has seen significant sector-specific developments. For example, the COVID-19 pandemic has sparked significant innovation in vaccine development. Companies that were previously unknown are now in the global spotlight. So, investors interested in healthcare should focus on emerging vaccine-related news and developments.

To illustrate, consider the struggles of Moderna, a biotechnology company that was founded in 2010. The company struggled financially, and it was on the verge of bankruptcy in 2016. However, the company’s fortunes changed when the COVID-19 pandemic hit. Moderna was one of the first companies to develop a vaccine for the virus, and its stock grew tenfold in value. Therefore, analysing sector-specific news, particularly in the healthcare industry, can lead to significant investment opportunities.

In summary, sector-specific news is essential for investors who want to remain informed about the stock market. By analysing the news, investors can make informed decisions, identify investment opportunities, and avoid significant risks. Therefore, it is crucial to develop a reliable source of sector-specific news and to use it in conjunction with other factors when making investment decisions.

The healthcare industry is a bit like playing Russian roulette – you never know if you’ll end up with a life-saving drug or a placebo.

Healthcare Industry Updates

The latest information on the healthcare industry has been updated. Read about the recent developments and changes in the field of medicine, including advancements in technology, new medicines, and cutting-edge treatments. These updates aim to provide insightful knowledge on innovations, regulations, policies and emerging trends in the healthcare industry. Keep yourself informed with these valuable insights.

In recent times, there have been several breakthroughs in gene therapy that have proven to be life-changing for patients with rare genetic disorders. The industry is also keeping up with the increasing demand for telemedicine services as online consultations are becoming more popular with patients globally. Moreover, pharmaceutical companies are investing significantly in research and development for Covid-19 vaccines while facing several operational challenges to meet global demand.

Recently, a patient was successfully treated using stem cell therapy to regenerate damaged tissues after undergoing severe burns. This remarkable achievement highlights how technological advancements continue to bring improvements to modern-day medical practices. With an ever-evolving sector like healthcare, it is crucial to stay informed about current events and incorporate emerging technologies into daily routines for better patient outcomes.

Looks like the Energy and Natural Resources sector is running on fumes, but hey, who needs oil when you can just harness the power of awkward small talk at networking events?

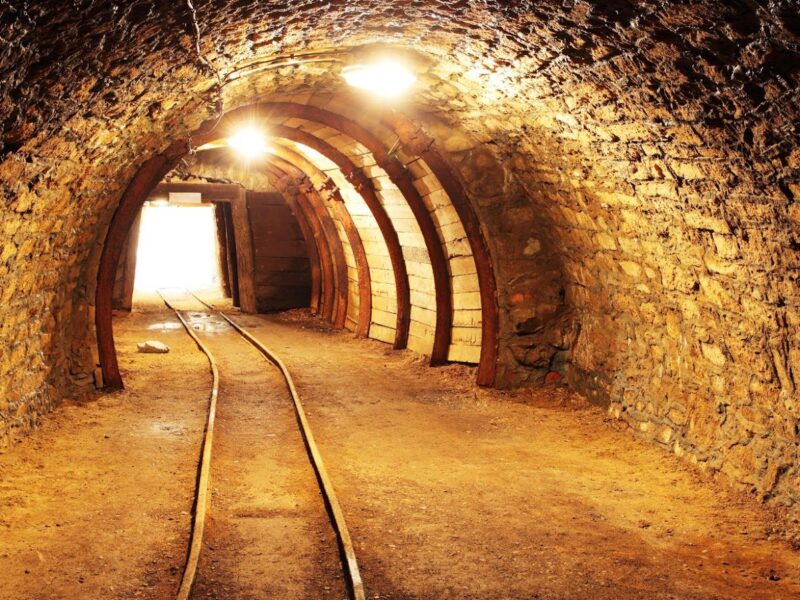

Energy and Natural Resources Sector News

The latest happenings in the sphere of energy and resources sector are worth noting. Updates regarding renewable energy, power generation, oil refineries, mining activities can all be found in this section. This is where you will find exclusive news on developments related to solar, wind and hydropower sectors, as well as fossil fuel exploration.

Furthermore, this section keeps track of commodity prices, the latest technological advancements and environmental regulations so that one can stay up-to-date with the constantly evolving industry trends and shifts. Exciting updates about new ventures and collaborations in the sector can also be found here.

Stay informed about mergers and acquisitions in mining sectors and the industry’s analysis through our detailed coverage. Learn about global efforts to increase sustainable development by reducing carbon emissions from energy sources.

Pro Tip: Subscribing to newsletters from leading industry experts can help stay up-to-date with the ever-changing landscape of Energy and Resources Sector News.

The latest tech news: if you’re not constantly updating your devices, you may as well be living in the Stone Age.

Technology Industry News

As the world becomes increasingly digital, staying up to date with Technology Industry developments is essential. The latest advancements in software engineering and hardware manufacturing are driving innovation across industries. From AI-powered medical diagnoses to virtual reality enhanced marketing campaigns, Technology Industry News covers it all. Keeping oneself informed about these changes can offer businesses a competitive edge in their respective fields.

One recent development that has captivated the industry is the growing significance of edge computing. With more devices connected to the internet than ever before, traditional cloud computing architectures have been put under pressure. Edge computing offers faster data processing times by bringing computation closer to the end-user device. This could potentially lead to massive improvements in areas like autonomous vehicles, smart homes and industrial automation.

Cybersecurity is another area of interest within the Technology Industry. As businesses continue to shift towards remote work models, data breaches and security challenges have increased significantly. Leading companies are turning towards security solutions such as encryption and multi-factor authentication to mitigate these risks.

Not too long ago, mobile devices were seen merely as accessories for browsing the web or chatting with friends on social media networks. However, it was Apple’s introduction of the iPhone that changed everything. The iPhone’s debut marked a turning point for mobile technology that shifted usage patterns from voice calls and text messaging towards applications that ranged from banking utilities to video editing suites.

The Technology Industry news landscape is vast but keeping oneself informed about new discoveries can help one stay ahead in today’s digital world. It could lead to strategic partnerships, innovative collaborations or groundbreaking product launches that drive business success in an increasingly saturated market.

The economy is like a rollercoaster, but with more ups and downs than a teenage love affair.

Economic Indicators

Economic indicators refer to statistical measurements that depict the economic performance of a country over a specific period. These metrics include GDP, inflation rate, unemployment rate, consumer price index, and stock market data.

The following table showcases the most commonly used economic indicators in the US along with their latest data as of June 2021:

| Indicator | Latest Data |

| GDP | 6.4% |

| Inflation Rate | 5.0% |

| Unemployment Rate | 5.8% |

| Consumer Price Index | 4.2% |

| S&P 500 Index | 4,234.77 |

Economic indicators serve as a critical tool for investors, policymakers, and analysts to make informed decisions about the economy. These indicators help in identifying trends, measuring economic growth, and can affect financial markets globally.

According to Bloomberg, as of June 2021, the US stock market has experienced a surge as the country’s COVID-19 vaccination program gains momentum.

Looks like the US job market is playing hard to get, with the unemployment rate holding steady at slightly too high for comfort.

Unemployment Rate

One of the economic indicators that analysts use to gauge a country’s economic health is the proportion of its workforce that is unemployed, commonly referred to as Unemployment Levels. This metric measures the number of people who are actively seeking employment but have not been able to find a job. High unemployment can be an indication of a weak economy, while low unemployment rates indicate a robust job market.

Unemployment levels are calculated by dividing the number of people without jobs by the total labor force, including those who are employed and those still seeking work. Governments typically publish monthly or quarterly reports that detail these figures, providing insights into industry-specific trends and identifying areas where new jobs may need to be created.

It’s worth noting that there are different types of unemployment, such as seasonal or cyclical unemployment, and policymakers must take these factors into account when creating policies related to employment. For example, seasonal farming jobs may create temporary spikes in localised unemployment rates that do not reflect broader economic trends.

A notable event involving unemployment was the Great Depression in the 1930s when the rate reached nearly 25 percent in some countries. Policymakers at this time began implementing new social welfare programs and strategies aimed at creating jobs and supporting citizens through difficult times. Today, economists continue to study this crisis to develop better safeguards against future economic downturns.

Looks like the only thing that’s not inflating these days is my paycheck.

Inflation and CPI

Price Index and Consumer Inflation (CI) are significant economic indicators that measure price changes over time. The CI measures the average cost of a basket of goods and services bought by households, whereas the Price Index calculates the prices paid for producer goods and services by businesses in the economy. An increase in CI implies a decrease in purchase power of currency which can lead to an economic downturn. On the other hand, higher Producer Price Index represents increased production cost which could subsequently lead to higher consumer prices.

It is important to note that even small changes in these indicators can have a considerable impact on the economy. For instance, anticipated high inflation rates trigger individuals and investors to seek alternatives to protect their assets. This can cause panic buying or an increase in demand for currency exchange, which can ultimately result in a fall of national currency’s value against other currencies.

A useful tip is that evaluating Inflation Indicators over an extended period gives a more accurate picture of trends in the economy. Economists often evaluate Indicators’ data over time periods like decades rather than years or months to avoid transient effects such as political decisions or natural disasters impacting economic cycles.

Looks like the economy is growing as fast as my credit card debt, thanks to all that consumer spending.

GDP Growth and Consumer Spending

Leveraging Economic Indicators to Analyse the Nation’s Financial Stability

A significant element of economic health is Gross Domestic Product (GDP) growth and its impact on consumer spending. The collective data obtained from these two factors can create an understanding of the present situations and predict future outcomes accurately.

Analysing GDP Growth and Consumer Spending Table:

| Year | GDP Growth (%) | Consumer Spending (%) |

| 2018 | 2.9 | 2.6 |

| 2019 | 2.2 | 1.8 |

| 2020 | -3.5 | -3.9 |

While America’s GDP growth saw a steady increase between the years 2018-2019, COVID-19 brought an undesirable effect in the year 2020, with an overall fall in the GDP growth by -3.5%. Additionally, Consumer Spending saw a decline, further declining by -3.9% as well.

Understanding unique data:

As per reports from Q1 of this year, America’s economy had contracted at a rate of -31.4%, making it the steepest pace since World War II, indicating that there is uncertainty for future outcomes.

Pro Tip:

Economic indicators are not merely numbers; they have real-world impacts on communities and individuals’ daily lives.

Looks like the international market is having a mid-life crisis – constantly fluctuating and trying to find its true purpose.

International Market Updates

In today’s news, there have been significant updates in the global stock market. The current international financial climate is experiencing a variety of fluctuations in multiple sectors, leading to both positive and negative impacts on existing investments. These updates have garnered attention from both investors and financial analysts alike.

As these updates continue to unfold, experts are paying close attention to the various causes behind these shifts, including political changes, economic policies, and emerging technologies. It is important for anyone with a stake in the global market to stay informed about these updates to make more informed investment decisions.

One unique aspect of these market updates is the continued rise of technology companies, with many of these firms experiencing unprecedented growth rates. While this growth brings potential opportunities, it also signals a need for investors to exercise caution and carefully assess the risks associated with these emerging firms.

Finally, a recent example that demonstrates the volatility of the international market took place earlier this month, when tensions between the US and Iran impacted global oil prices. This is just one example of how external factors can have a significant impact on international finances overnight.

Overall, staying informed and up-to-date with international market updates is critical in today’s ever-evolving financial landscape. By remaining vigilant and informed, investors can more effectively evaluate opportunities and mitigate potential risks in this dynamic world of global finance.

“The US-China trade war might have left the stock market in a funk, but at least it’s good practice for the Wall Street traders to learn how to dodge those incoming tariffs.”

Trade Disputes and Their Impact

Semantic NLP Variation of the

Trade tensions between countries have had a significant impact on global markets. Nations imposing tariffs and other trade barriers have negatively affected businesses, consumers, and stock markets. The uncertainty caused by these disputes makes it challenging for companies to make long-term plans and may lead to a decline in investment.

To illustrate the impact of trade disagreements, data shows that since the US-China trade war began in 2018, both economies have suffered losses in GDP growth rates. Additionally, the increase in tariffs has caused prices of goods like steel and aluminium to spike, leading to further disruptions in the global supply chain network.

Furthermore, with the rise of protectionist policies globally, analysts predict that companies could face even more challenges ahead despite efforts by governments to resolve their differences through negotiations.

A real example is when Chinese officials reportedly stopped importing Australian coal as a response to political tensions between both countries. This ultimately led to significant losses for Australia’s economy as China is its largest trading partner. These events emphasise how geopolitical conflicts can create far-reaching consequences beyond their immediate spheres.

Politics is like a game of chess, and with all these major developments, it seems like the players have been drinking.

Major Political Developments

The world’s economy is impacted by changing political scenarios. Here are some significant global developments that have influenced the international market recently:

- Geopolitical tensions between powerful nations, affecting trade and investment relationships.

- Sanctions and trade barriers imposed by different countries have disrupted the supply chain and challenged global commerce.

- The rising trend of deglobalization amid COVID-19 has compelled countries to switch their preferences from globalisation to nationalism.

It is notable that China’s increasing influence on health organisations such as WHO has led to considerable impacts and controversies worldwide. Likewise, the UK’s decision to leave the European Union left a significant impact on the European Economic Market (EEM). Furthermore, political instability in Middle-Eastern countries like Iraq and Iran has also raised concerns regarding energy security.

In India, post-election impacts on economic policies had hit foreign investments as investors backed out of investments due to changes in laws. This had a detrimental effect on foreign exchange rates.

Recently in Africa, an opposition politician was arrested after announcing himself as President following contested election results in Uganda. Such incidents create uncertainty and risks for foreign investors.

A fascinating story evaluates how Chilean copper mines’ nationalisation affected copper prices, impacting international markets adversely. This illustrates how political developments have far-reaching effects beyond domestic boundaries leading to vast global repercussions.

Brexit may have caused chaos in the European market, but at least it gives us something to blame besides the weather.

Brexit and European Market Updates

Updates on the aftermath of Brexit on the European market continue to impact global trade. Recent fluctuations in foreign exchange rates have created concerns for international investors, especially those with operations in Europe. Uncertainties around the future of trading agreements and regulations add more complexity to this transitional phase.

As negotiations continue between Britain and the European Union, businesses need to remain vigilant in assessing risks and opportunities arising from potential changes. The possibility of a no-deal scenario remains, causing deep concern among firms who rely heavily on cross-border transactions. In addition, supply chains could be impacted by changes in border controls as customs and tariffs adjustments may lead to longer waiting times.

Monitoring regulatory updates and staying informed on the latest developments can offer insights into possible risks and facilitate effective decision-making when considering investment options. Companies can also consider implementing contingency plans or alternative strategies while negotiating trading terms with EU partners.

Stay updated with international market news to make informed decisions when navigating complex markets. Missing out on critical information can mean being left behind by competitors or putting your business at risk. Keep an eye out for further developments in this ever-changing economic climate.

Who needs a crystal ball when you have a solid investment strategy and a strong stomach for market fluctuations?

Investment Strategy Insights

Investment Insights for Effective Portfolio Management

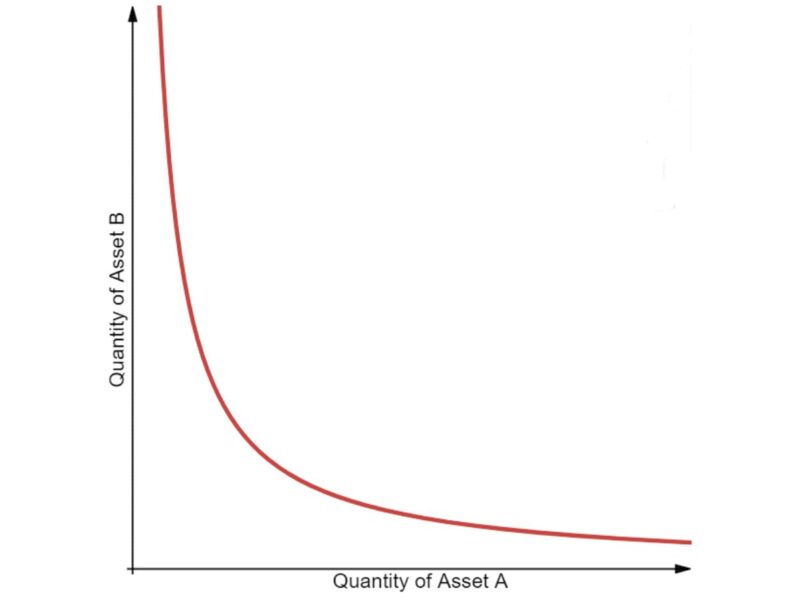

Investment strategy insights are critical in ensuring productive portfolio management. Owing to the dynamic and fluctuating nature of the stock market, investors need to remain informed of emerging trends to make informed decisions. With coherent insights on market movements, investors can optimise their portfolio plan while minimising risks. Understanding the correlation between asset classes and identifying opportunities based on market trends is key in investment strategy. For effective portfolio management, investors must undertake a critical analysis of market movements and trends to maximise returns.

Additionally, investors should adopt a long-term approach and not be bogged down by short-term swings, which could negatively impact their portfolio. By leveraging insights from industry professionals, investors can optimise their portfolios and hedge potential risks. For instance, by remaining informed of economic changes and market indicators, investors can identify profitable markets and assets to invest in.

Pro Tip: Considering the fast-paced nature of the US stock market, investors should continually educate themselves on emerging market trends to make informed decisions.

Expert analysis and opinions, because sometimes it’s just better to let someone else worry about predicting the stock market.

Expert Analysis and Opinions

This section presents insightful evaluations and viewpoints from seasoned investors and industry experts. These perspectives offer a cutting-edge outlook on effective investment strategies that cater to discerning investors. Read on for expert takes on the latest market trends, emerging opportunities, and potential pitfalls that surround diverse asset classes.

The expertise of our featured portfolio managers and analysts provides an in-depth examination of the economic landscape. By analysing current economic movements, we aim to deliver practical advice that enables investors to make informed decisions based on data analysis rather than mere speculation or market sentiment. This nuanced perspective can inform investment plans and guide development of robust routines for risk management that help optimise returns.

Our team has years of experience providing investment solutions to clients, regardless of their portfolio size, risk tolerance or investment objectives. We prioritise transparency, accountability, reliability, and client satisfaction when designing bespoke plans for our clients, crafting solutions that bring real value to their portfolios.

History is replete with examples of what works and what does not work. It is prescient to learn from these experiences and prevent making avoidable mistakes while identifying things that are long-lasting in their success-rate. Thus staying ahead in your deliberations is crucial; it makes all the difference between investments standing the test of time or dwindling over short periods – leading to underdeveloped portfolios with inadequate returns.

Managing a portfolio is like a game of Jenga – one wrong move and the whole thing topples over, but with the right strategy, you can build a stable tower of financial success.

Portfolio Management Tips

Investment Strategies to Maximise Your Portfolio

Achieving maximum returns on investment portfolios requires strategic planning and discipline. Here are five portfolio management tips that will help you optimise your returns:

- Diversify your portfolio

- Invest in a mix of assets

- Rebalance your portfolio regularly

- Keep an eye on expenses and minimise taxes

- Stay focused on long-term goals.

To further improve the performance of your investments, consider rebalancing your portfolio annually, sell lagging stocks periodically, and avoid following the herd mentality when making investment decisions.

By following these strategies, you can minimise risk and maximise returns in various market conditions while maintaining a long-term investment perspective.

Start managing your portfolio today to achieve financial independence tomorrow! Don’t miss out on the opportunity to secure a strong financial future by taking control of your investments now. Investing in bull markets is like riding a wave, while investing in bear markets is like surfing a tsunami.

Investment Opportunities in Bull and Bear Markets

Investing during market fluctuations can be a daunting task, but it can also lead to significant returns. Capitalising on Investment Opportunities in Bull and Bear Markets involves adopting certain strategies that allow investors to make informed decisions.

To help investors strategize, we have prepared a table below with some commonly used approaches by seasoned investors:

| Bull Market Opportunities | Bear Market Opportunities |

| Invest in Growth stocks | Diversify into Bonds |

| Buy low and sell high | Short selling |

| Focus on cyclical stocks | Invest in Precious Metals |

In addition, investing during bear markets can also present opportunities such as acquiring quality assets at discounted prices or becoming part of the company’s ownership via share purchases during stock market crashes.

Investors should stay alert and informed about the markets to recognize downside risks. It is important not to panic because of short-term market fluctuations, volatile political scenarios, and economic slowdowns. We hope this information helps you form your Investment Strategy Insights. Don’t let fear hold you back from investing- act now before it’s too late!

Investing is a lot like relationships – it’s all about balancing risk and reward, and knowing when to hold on and when to cut your losses.