Table of Contents

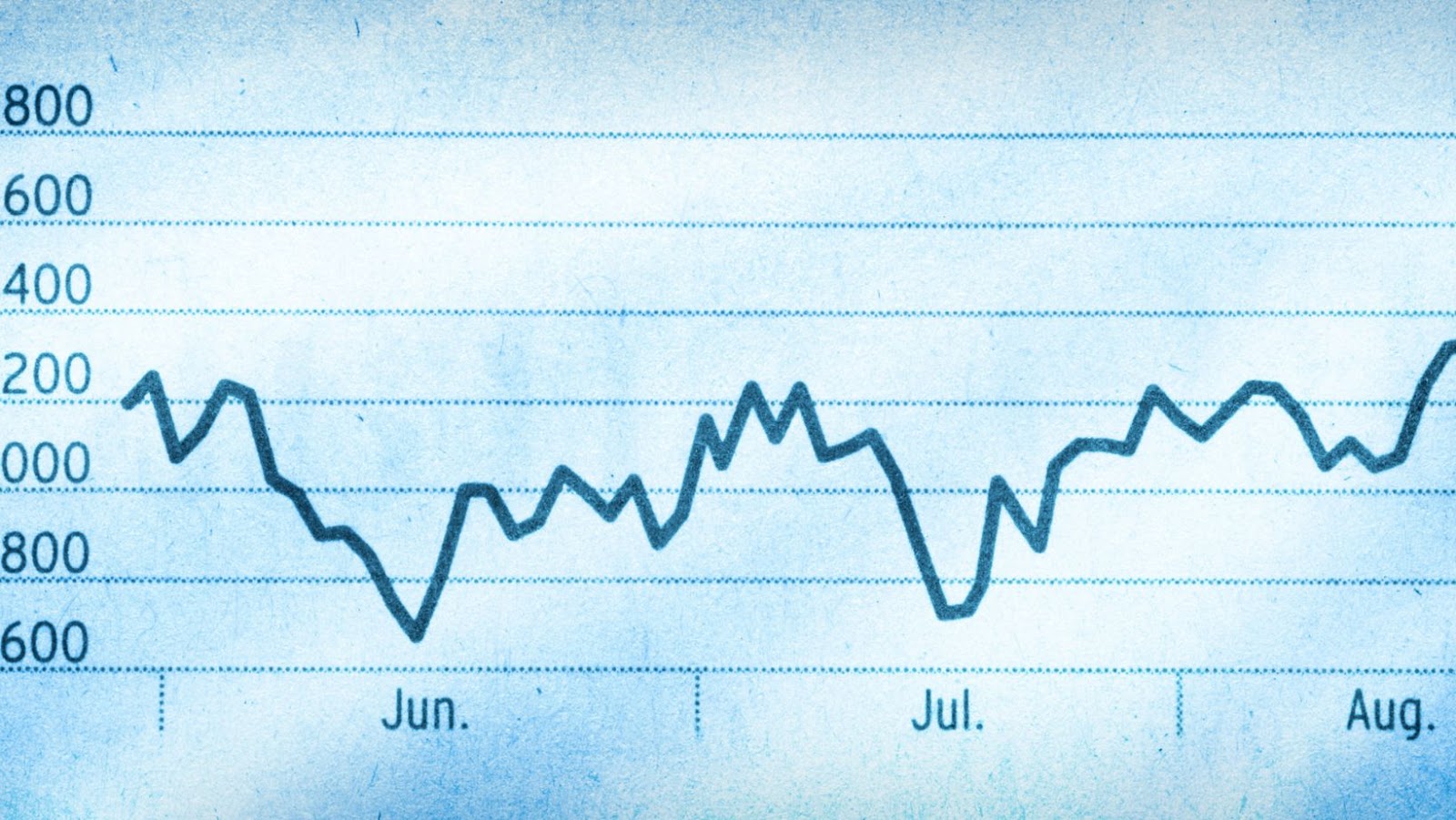

Nasdaq notched its second consecutive day of gains as investors continued to buy up beaten-down tech stocks such as Tesla. Despite the market showing signs of volatility, the Nasdaq Index rose by 0.7% on Thursday, continuing its upward trend. This has been the second day in a row that the Nasdaq has risen, following a 2.3% surge on Wednesday.

Let’s take a closer look at how the Nasdaq performed and how this will affect the future of tech investments.

Overview of Nasdaq’s Performance

The Nasdaq Composite Index gained 46.43 points, or 0.5%, to 10,020 as of 4 p.m. ET, following a 2% surge Tuesday. Heavyweight stocks like Apple, Microsoft and Amazon rose, helping to buoy the index’s gains for the day.

Tesla saw notable gains on Wednesday, with its shares up more than 3%. The electric-car maker has seen its stock price drop in recent weeks after a disappointing outlook from Elon Musk sent investors scurrying away from Tesla and other now tumbling tech names in early June; however strong bullish momentum has been seen as investors continued to reshuffle their portfolios and buy into this once beaten down name since then.

The broader recovery seen at the tech-heavy Nasdaq was held back by declines in chipmakers Nvidia and Qualcomm, which were two of the index’s top decliners on Wednesday’s session. Both companies reported earnings on Tuesday that failed to meet Wall Street forecasts; investors swept out en masse, sending both stocks down 5%.

Wednesday marked the second day of consecutive gains for Nasdaq which has faced significant pressure this quarter due to prevailing uncertainties surrounding the global pandemic situation; coronavirus cases have spiked again in several American states with health officials’ warning that businesses may have reopened too soon with many having had to subsequently shutter again in response to the rapid outbreak. Nonetheless Tech has managed overall better than expected surges over recent days despite these reminders of an uncertain economic future with President Trump’s measured messages about containing Covid-19 possessing some potential for calming markets going forward.

On Wednesday, the Nasdaq notched its second day of solid gains, and investors are buying beaten-up tech shares like Tesla. This shows that the investors are confident in the markets and are willing to take risks.

On the heels of bipartisan stimulus efforts and successful approaches to coronavirus vaccinations, investors have been buying up the shares of “beaten-up” technology companies like Tesla Inc. This has been part of a larger trend that has driven the Nasdaq 100 index to an all-time high.

This renewed optimism with Technology has been accompanied by an increased willingness of risk capital, as well as investor confidence in the ability of companies to accelerate into economic recovery. Aside from technology stocks, several other sectors, such as materials and energy, are benefiting from this shift.

The Uptrend can also be credited to large cash inflows from overseas investors interested in gaining exposure to US technology stocks due to their relative safety compared to emerging markets and other non-US equities. Additionally, some investors have taken advantage of record low interest rates by opting for attractive dividend yields generated by tech stocks instead of choosing bonds for their portfolios.

Central banks worldwide have also helped mitigate headwinds alongside budget measurements implemented earlier this year in many parts of the world. In addition, global stimulus programs that came on the heels of respective lockdowns also pushed equities higher as countries began emerging from coronavirus induced recessions.

These factors can explain why we’re seeing Nasdaq notching second day gains – investors show enthusiasm for beaten up sectors like Technology. At the same time, central banks help reduce headwinds due to long term trends and global stimulus measures coming on board during 2020 helping markets emerge from recessionary pressures caused by COVID-19 earlier this year.

Positive Earnings Reports

Positive earnings reports can be a key driver of the Nasdaq’s trend. Over the last couple of days, several notable tech companies such as Apple Inc. and Microsoft Corporation reported strong quarterly earnings, indicating promising growth in their respective businesses. This likely influenced investor sentiment regarding these stocks, leading to more investors purchasing them and increasing the market’s overall price level.

In addition, other tech giants such as Amazon, Alphabet and Intel also released better-than-expected performance figures during this earnings season, which helped further bolster investor confidence in the sector and contribute to its uptrend. Additionally, tech stocks such as Tesla Inc., beaten down due to lackluster performance before this earnings season, experienced a surge in stock prices after posting stronger earnings results than expected.

Overall, positive earnings reports from prominent tech companies have given investors greater conviction in the sector’s potential for growth and have acted as a major catalyst for the Nasdaq’s rising trend over the last two days.

Impact of the Uptrend

Investors worldwide have been looking for opportunities to maximize their profits, and the Nasdaq stock exchange has been a major focus for the past two days. Investors have been taking advantage of the uptrend, buying up beaten-down tech shares like Tesla and others, leading to the Nasdaq notching its second day of gains.

Let us look at how this trend is affecting the markets and how it will likely play out in the coming days.

Positive Impact on the Stock Market

The Nasdaq continued its historic uptrend on Wednesday, driven by strong demand for technology stocks such as Tesla and other recently beaten-up ideas. As a result, the index notched a second consecutive day of gains, closing the day above 13,000 points. This shows that investors continue investing in some of the tech sector’s most promising stocks, pushing the market further into record levels.

The Nasdaq’s current trend has had a positive impact on the stock market as a whole. It has lifted investor sentiment and allowed companies to raise capital through stock offerings. Demand from investors has also helped fuel bullish activity in some sectors and pushed equity valuations higher. Additionally, increased activity in the stock market has reopened doors for some industries that have been hard hit by COVID-19 such as travel, hospitality and dining.

This uptrend does have its drawbacks though; concerns about inflationary pressures remain high among investors as asset prices rise dramatically due to greater demand for anything with an online presence or ties to technology or stay-at-home activities. The Federal Reserve is also watching this market activity closely. It may increase interest rates if it becomes concerned about economies overheating too quickly due to rising prices and overleveraged markets.

However, investors remain optimistic that this upward trend will continue into 2021 despite possible risks of stiffer regulation or higher inflation.

Positive Impact on Investors

The Nasdaq’s continued uptrend is positively impacting investors, particularly those trading in tech shares. Technology stocks have been among the hardest hit by the pandemic, with many taking big hits in 2020. However, since February 2021, some of these stocks have rebounded and are now seeing big gains as investors take advantage of the Nasdaq’s rise. Tesla is a notable example, with its share prices rising more than 20% since March 2021.

This has boosted investors who were patient enough to wait out the pandemic’s downturn and are now rewarded for their faith in technology stocks. This leads to increased confidence in tech investing at large, potentially leading to further growth in Nasdaq indices going forward. It also speaks to the long-term value of investing in tech; if shares fall due to factors outside investors’ control (i.e., the pandemic), then there is still potential for a recovery over time as long as market fundamentals remain sound.

Conclusion

The Nasdaq Composite continued its upwards trend, notching a second consecutive day of gains as investors bought beaten-up tech shares like Tesla. The index climbed 0.4 percent to 12,157.73 and is now up 2.5 percent over the past two days.

The rally was mainly driven by strong gains in the technology sector, which rose 1 percent on the day and is now up 4 percent for August. The performance was also buoyed by higher oil prices and better-than-expected economic data out of China, reassuring that a recovery is occurring despite mounting coronavirus cases in many U.S. states.

Despite this one-two punch, NASDAQ is still down 12 percent in recent weeks and remains 11 points shy of its record close set back in mid-February before covid19 crisis began to spread worldwide.

tags = Dow Jones Industrial Average dropped 112.96 points, chunk of those gains came Friday, classic Wall Street rule, Nasdaq Composite, nasdaq thursday friday 100m ipo 650mnovetcnbc